In partnership with industry leaders

Ruby

Empower your travel agency with finance purpose-built for travel.

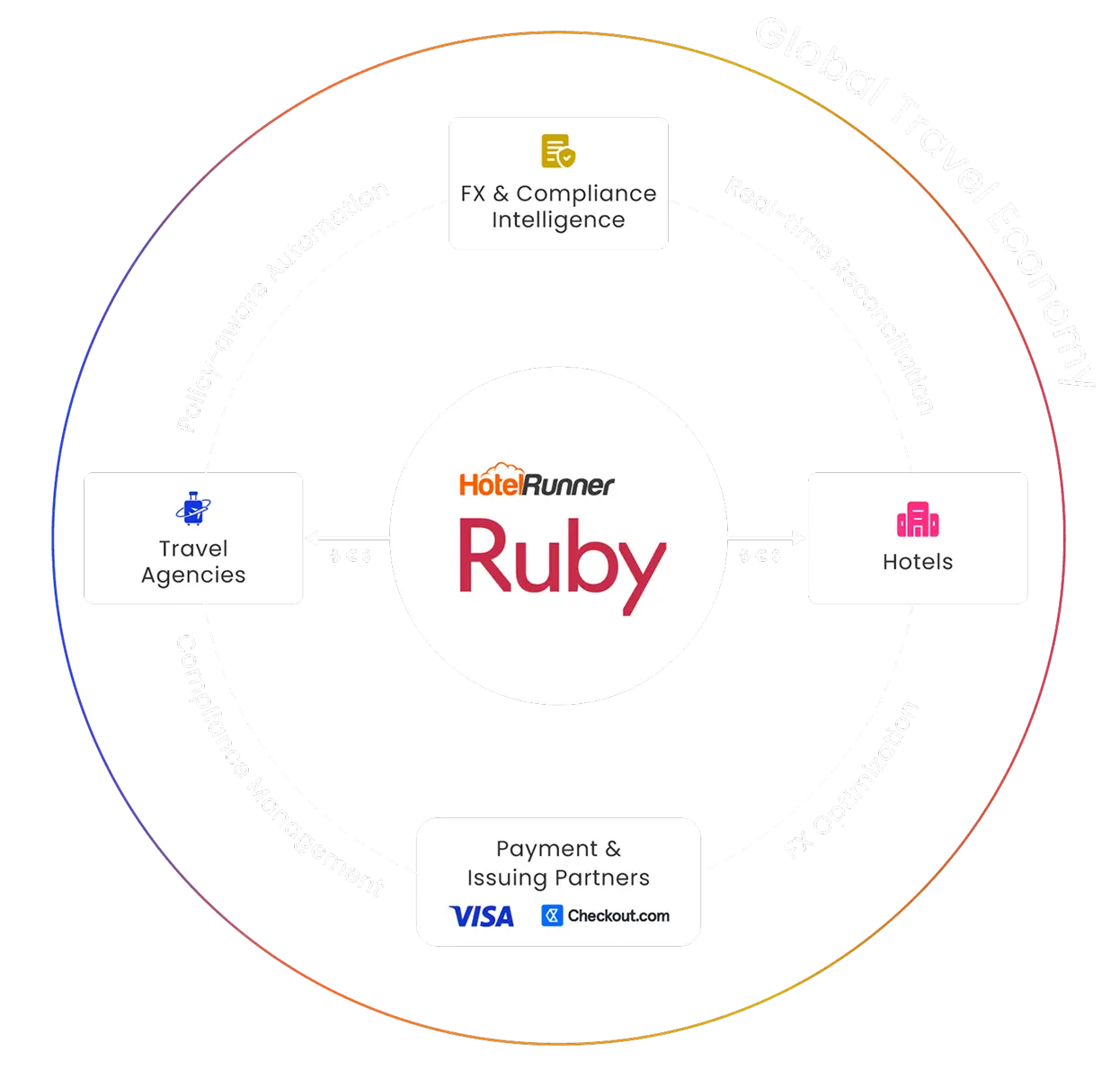

Ruby automates payments with global partners—cutting settlement costs, eliminating frictions, enabling instant accommodation onboarding, and unlocking new revenue by improving margins through faster, more secure, and smarter financial flows.

Scale globally. Grow profitably. Settle instantly.

Scale globally. Grow profitably. Settle instantly.

Reimagining finance for travel

Finance, native to travel.

For decades, the travel industry was relying on generic finance tools for payments. Ruby changes this.

End settlement delays, eliminate frictions, cut costs, and unify global distribution with secure and instant payments. Ruby is the autonomous and embedded finance infrastructure designed for the travel industry. Built on trust, speed, and transparency.

Ruby is an API-first infrastructure and platform built specifically for the high-volume, multi-currency, multi-jurisdiction, and cross-border complexities of travel transactions.

Automated Settlements

Instantly reconcile bookings, invoices, and commissions with full accuracy and zero manual effort.

Instant Global Payouts

Pay and get paid across currencies and markets without delays or FX friction.

Policy-aware Infrastructure

Built to understand travel-specific rules, rate plans, and cancellations for true financial autonomy.

Pre-configured with travel-specific policies and rules

Handle the unique regulations, workflows, and partner relationships specific to the industry easily.

Embedded payments and settlements

Automate financial flows across borders in real-time.

Multi-currency, FX-optimized transactions

Reduce costs, speed up transfers, and improve margins.

Automated reconciliation

Every transaction is tracked, matched, and settled instantly.

Built-in compliance

KYC (Know Your Customer), fraud prevention, and policy management integrated by default.

Data-driven risk management

Financial and non-financial signals help anticipate risks before they happen.

Ready to power your payments with Ruby?

Meet with our fintech experts at HotelRunner and discover how Ruby can transform your travel business.

Frequently asked questions

What is Ruby?

Ruby is HotelRunner’s embedded financial infrastructure built exclusively for the travel industry. It enables instant settlements, transparent payments, automated reconciliation, and compliance for local and cross-border travel transactions.

How is Ruby different from other payment solutions?

Unlike generic financial tools adapted for travel, Ruby is native to travel. It unites distribution and payments into one infrastructure, removing delays, FX inefficiencies, and manual reconciliation.

Who can use Ruby?

Ruby is designed for travel agencies, tour operators, suppliers, and accommodation providers who are part of the HotelRunner B2B Network.

What problems does Ruby solve?

Ruby eliminates settlement delays, reduces FX costs, simplifies compliance, and prevents fraud and chargebacks. It transforms traditionally manual and risky financial processes into automated, secure, and transparent flows.

Does Ruby handle compliance and KYC?

Yes. Ruby embeds compliance into every transaction, including KYC, AML, and fraud prevention. These processes run automatically in the background, ensuring you remain compliant with global regulations.

Can Ruby process multi-currency payments?

Absolutely. Ruby is built for global travel. It supports multi-currency transactions and FX management, giving partners flexibility and control over international settlements.

How does Ruby improve cash flow for travel businesses?

Ruby significantly improves cash flow by providing instant settlements and automating reconciliation. By eliminating the traditional delays associated with wire transfers and virtual card issuing, it ensures that funds are processed and matched instantly across borders, giving travel agencies, tour operators, and suppliers faster access to their money and improving overall financial agility.

What does it mean that Ruby is "embedded" financial infrastructure?

It means Ruby's financial layer is built directly into the core B2B travel experience, not simply added on top of it. This unity of distribution and payments allows for real-time, automated financial flows across borders. By being embedded, Ruby eliminates manual steps, integrates compliance by default, and processes settlements seamlessly as part of the booking and distribution process.

Does it integrate with our booking systems?

Ruby is the embedded financial infrastructure that powers the HotelRunner B2B Network. It is designed to unite distribution and payments into one single, seamless infrastructure. For all partners within the HotelRunner ecosystem (travel agencies, suppliers, etc.), Ruby functions as a native, end-to-end financial layer integrated directly into the travel content and booking flows.

Is it secure?

Absolutely. Security and compliance are built into Ruby by default. It embeds compliance into every transaction, including KYC (Know Your Customer), AML (Anti-Money Laundering), and fraud prevention. Furthermore, Ruby uses a data-driven risk management approach, combining financial and non-financial data to anticipate and prevent risks like fraud and chargebacks before they happen.

How does this help with reconciliation?

Ruby automates reconciliation completely. Every transaction, regardless of the payment type, is tracked, matched, and settled instantly within the unified infrastructure. This eliminates the need for manual tracking and matching of payments with bookings, transforming traditionally manual and risky financial processes into automated, secure, and transparent flows.

Can I issue cards for individual bookings or suppliers?

Yes, you can generate single-use or multi-use virtual cards tailored to each booking, supplier, or service.